Latest News

10th July 2025

Traveller Removal Review

News,

DCBL prides itself on the fantastic reviews left by our valued customers. Just recently we received this brilliant review after helping a customer remove travellers from their land: Re: Trespassers … Continued

Read Article

20th June 2025

1 in 3 say better visibility of personal finances improves mental wellbeing

News,

DCBL has been featured by Fintech Finance News. Our recent study of 2,000 people in the UK revealed that ‘1 in 3 say better visibility of personal finances improves mental wellbeing’. … Continued

Read Article

10th June 2025

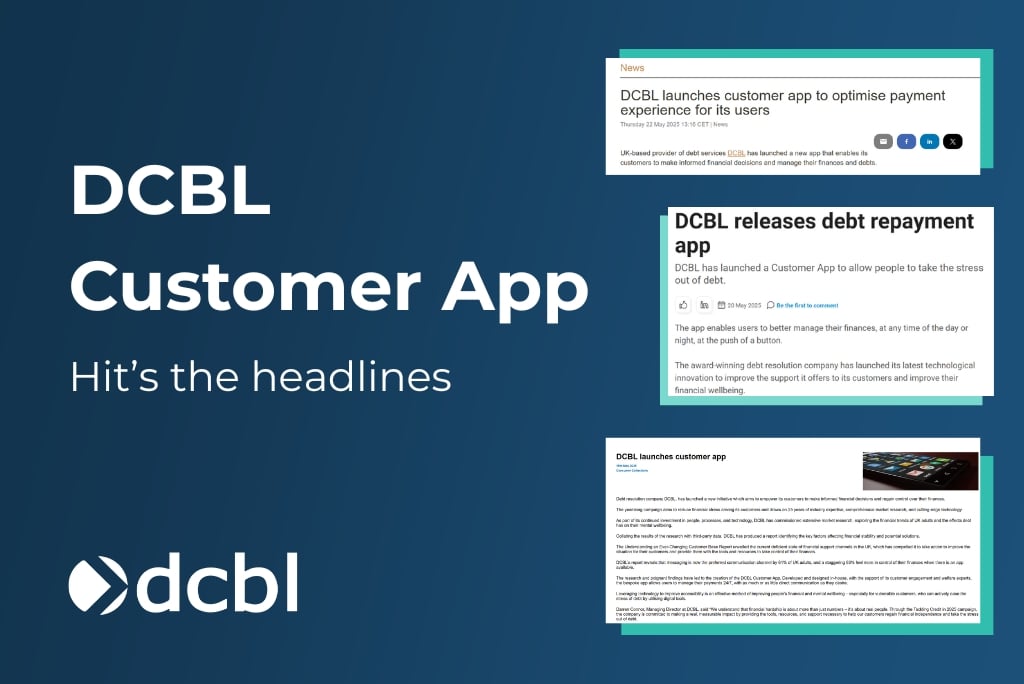

DCBL App makes the headlines

News,

We recently launched our ground-breaking App, which attracted heavy media coverage from many leading platforms, such as Credit Connect, Finextra, National World and The Paypers, the DCBL App has gained … Continued

Read Article

4th June 2025

Client Review – Marc Rhodes

News,

At DCBL we love to celebrate our colleagues’ hard work and success. This excellent review highlights the fantastic work done by our debt resolution team members, Jack and Tony, who … Continued

Read Article

2nd June 2025

DCBL debuts Customer App that brings peace of mind to payments

News,

Our revolutionary Customer App continues to capture the headlines, as Business Cheshire, highlights the comprehensive market research that informed its development. “In its pursuit of continual improvement, DCBL has expanded … Continued

Read Article

27th May 2025

Vicky Felton Appointment Captures Headlines

News,

DCBL’s recent appointment of Vicky Felton as Director of Operations has inspired coverage in multiple business news platforms, including BDaily, The Business Desk and Contact Centre Monthly. BDaily, a digital … Continued

Read Article

23rd May 2025

DCBL App hits the headlines

News,

Following its successful launch last week, our innovative customer focused app has garnered a lot of positive attention from news outlets! As explored in Paypers recent feature, the development of … Continued

Read Article

20th May 2025

DCBL Launches Customer App – Finextra News

News,

Fintech news outlet, Finextra, covered the release of our latest innovation: the DCBL Customer App. The article states: The proprietary app, available on the App Store and Google Play, features … Continued

Read Article

19th May 2025

Download the DCBL Customer App

News,

DCBL Customer App – Taking the stress out of debt Our market research found that the vast majority (93%) of people felt more in control of their finances when there … Continued

Read Article

16th May 2025

Welcome to DCBL – Vicky Felton

News,

We are delighted to welcome on board, Vicky Felton, as Operations Director With over 25 years of industry leadership experience, Vicky brings a wealth of knowledge to DCBL, as she … Continued

Read Article

8th May 2025

DCBL & Parkingeye Announce New 4 Year Exclusivity Deal

News,

DCBL & Parkingeye, a relationship built on success! Extending their partnership in a new four-year exclusivity deal, the UK’s leading debt-resolution provider, DCBL, and Europe’s largest car park management company, … Continued

Read Article

8th May 2025

Tackling Credit in 2025

News,

Taking the stress out of debt Drawing on 25 years of industry expertise, comprehensive market research, and cutting-edge technology; our year long campaign, Tackling Credit in 2025, aims to reduce … Continued

Read Article

2nd May 2025

Historic by-election win at the DCBL Stadium

News,

It was a busy night at the DCBL Stadium as votes were counted late into the night for the Runcorn and Helsby by-election. The DCBL Stadium is no stranger to … Continued

Read Article

1st May 2025

St Ann’s Hospice Marathon Fundraiser

News,

DCBL is proud to stand behind our Business Development Manager, Paula, as her incredible children, Isabella and Louis, take on the Manchester Half Marathon this October — in loving memory … Continued

Read Article

4th April 2025

Widnes Vikings – 1895 Cup Quarter Final

News,

The mighty Vikings are only 2 wins away from a trip to Wembley! This Sunday, Widnes Vikings take on York Knights in the 1895 Cup Quarter Final at the LNER … Continued

Read Article