What is the Process of Debt Collection?

23rd March 2020

Process of Debt Collection – Are you owed money and need to collect it as quickly as possible? Maybe you haven’t ever needed to chase payments before and are interested in the benefits of using a debt collection agency, but are unsure about what’s involved?

Don’t worry, it’s a question we get all the time at DCBL.

You’ll be glad to hear that DCBL successfully recovers tens of millions of pounds for our clients each year while maintaining a 98% client retention rate. We’re industry-leading experts and can guide you through the process to make it as simple as possible for you.

You don’t need a court judgment to start the process of collecting your money, so call us today on 0203 298 0201 (or fill in our contact form) to discuss your situation.

Already got a CCJ? Read about our High Court Enforcement services here.

Talk to us about your situation – Process of Debt Collection

The first step is to pick up the phone and talk to one of our debt collection experts. We will ask you for the details of your specific situation, including who owes you the money, how much money they owe you, and how long it’s been owed. This will enable us to determine if it’s something we can assist with and allows us to tailor our recovery methods to get the best possible result for your case.

Before going ahead we’ll also need evidence of how the debt has been accumulated, such as an invoice, purchase order, contract or agreement.

On instruction full financial checks including asset and address verification will be obtained on principle. This provides us with real-time data derived from credit links, which gives us the debtor’s most recent address and allows us to assess their financial profile.

Following our in-depth checks, if we feel your situation is irrecoverable, we will tell you. We don’t waste our time, or your money chasing rainbows.

You will also be assigned your own account manager as a constant point of contact. They will keep you updated throughout the duration of the case, offering advice and support and answering any questions you may have.

Letters and phone calls to the debtor – Process of Debt Collection

While we pride ourselves on the effectiveness of our face-to-face approach, the first stage of recovering your debt is always to contact your debtor via letters and phone calls. This informs the debtor we are acting on your behalf and gives them the opportunity to pay before the matter is escalated any further.

Our recovery letters are proven to have a 25% higher collection rate compared to our competitors due to the unique brand and media awareness as a result of our participation in the very popular Channel 5 & Netflix TV series “Can’t Pay? We’ll Take It Away!”

However, should your debtor not respond to our phone calls and letters, we move on to the next stage – face-to-face visits.

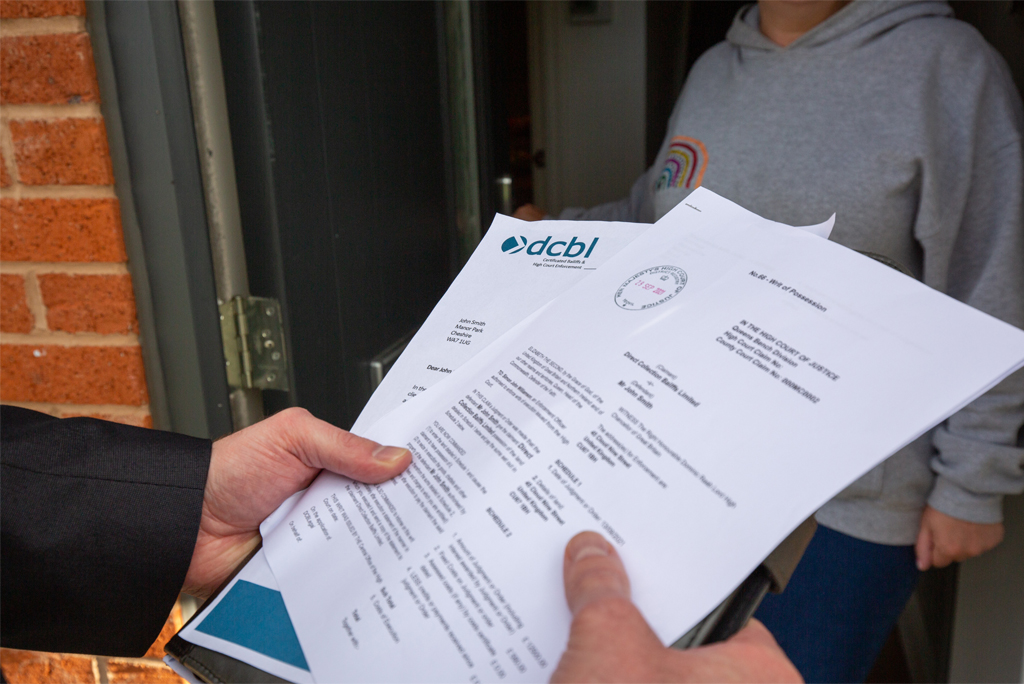

Face-to-face visits to the debtor

No debtor appreciates a knock on the door from a debt collection agent. A face-to-face visit is often the most effective way to pursue a stubborn debtor who refuses to acknowledge what they owe, no matter how many emails and letters they have been sent.

Years of experience in the industry have taught us to continually assess each situation as the circumstances of the visit can quickly change without warning. All our highly trained and experienced agents have excellent knowledge of debt collection, and how different kinds of debtors are likely to respond.

Our professional approach also ensures that we protect both our reputation and yours. We understand that we are representing you and that you may wish to maintain as good a relationship with your client as possible, even when collecting overdue payments.

You’ll also get a detailed report of each visit, so you’re always kept fully informed.

In most cases, a face-to-face visit is enough for most debtors to pay up. However, there are a small number of cases that require further enforcement in order to get a result. Thankfully, due to Direct Group’s unique capabilities, we can work with our sister company DCB Legal to provide a seamless debt recovery journey from the first reminder letter to agent enforcement.

One solution. Debt recovery made simple.

By instructing DCBL for your debt collection, we take all the stress away from you. If you have any questions about our services or would like to see if we can help you recover what you are owed, call us today on 0203 298 0201 (or fill in our contact form) to discuss your situation.